As a landlord, you are responsible for fixing any emergencies that occur in your rented property. Home Emergency Insurance ensures the cost of said emergency, as well as any repairs that may be required, is covered.

The emergencies covered include incidents such as the loss of keys, bathroom leaks, electrical issues, sudden boiler breakdowns, pest control, and much more. The insurance coverage also ensures you can provide alternative accommodation, should it be needed. Of course, all of this can become very costly without the help of Home Emergency Insurance, which is why it is a crucial consideration for any landlord.

The winter months, in particular, are where the need for Home Emergency Insurance ramps up. This colder period can be a huge financial burden for those unprepared and who do not have a policy in place. Due to the weather changing, there is naturally an increase in boiler issues and leaks, which can cause ceilings to crumble or, in the worst cases, cave entirely.

When looking into Home Emergency Insurance, it is important to note it is up to the broker to determine what an emergency is. For example, losing your keys or being unable to get into your house is an emergency. For general home repairs that occur due to everyday tear and wear, your tenant will need to look into getting a tenant’s Contents Insurance, such as the one provided by Mashroom, which will cover this. Home Emergency Insurance is reserved for those sudden unexpected incidents you do not see coming, such as adverse weather conditions. Even broader concerns like global warming and its impact on the environment are causing issues for landlords, such as flooding due to storms. While Home Emergency Insurance covers the call-out fees and cost of immediate repairs, it will not cover the costs of repairing the full damages caused by the emergency. This is where your tenants’ Contents Insurance policy will come into play.

Having a Home Emergency Insurance policy in place can be far cheaper than having to pay for emergency services yourself. It takes the worry away from figuring out how you’re going to pay for emergency call-out rates and repairs, which are often expensive due to the urgency of the issue. What’s more, you can rest assured that the contractor provided has been fully vetted through an auditing process, as we make sure they are managed by our claims supplier CPA.

At Mashroom, we provide a nationwide 24/7 helpline service all year round, so that claims can be registered without delay, no matter the time of day or night. The authorised repair personnel will carry out the emergency repairs within the time scale provided, weather and traffic permitting. This includes emergencies that take place over the weekend. Importantly, in contrast to Rent Guarantee Insurance, you can have a Home Emergency Insurance policy in place and in use while the property is vacant.

Our Home Emergency Insurance covers incidents such as overnight accommodation, and up to £250 of boiler cover. Our policy, however, does not include replacing boiler parts or appliances, or boilers that have not been serviced in over 12 months. Temporary repairs may be done to resolve an immediate emergency; however, permanent repairs will not be covered as per the Residential Landlord Emergency Assistance Policy. For instance, if something happened to your ceiling, under the confines of the policy, we would not be able to offer a full repair; however, we would provide a small service to prevent further damage to the property. For more details or if you have questions about what our Home Emergency Insurance covers, please get in touch.

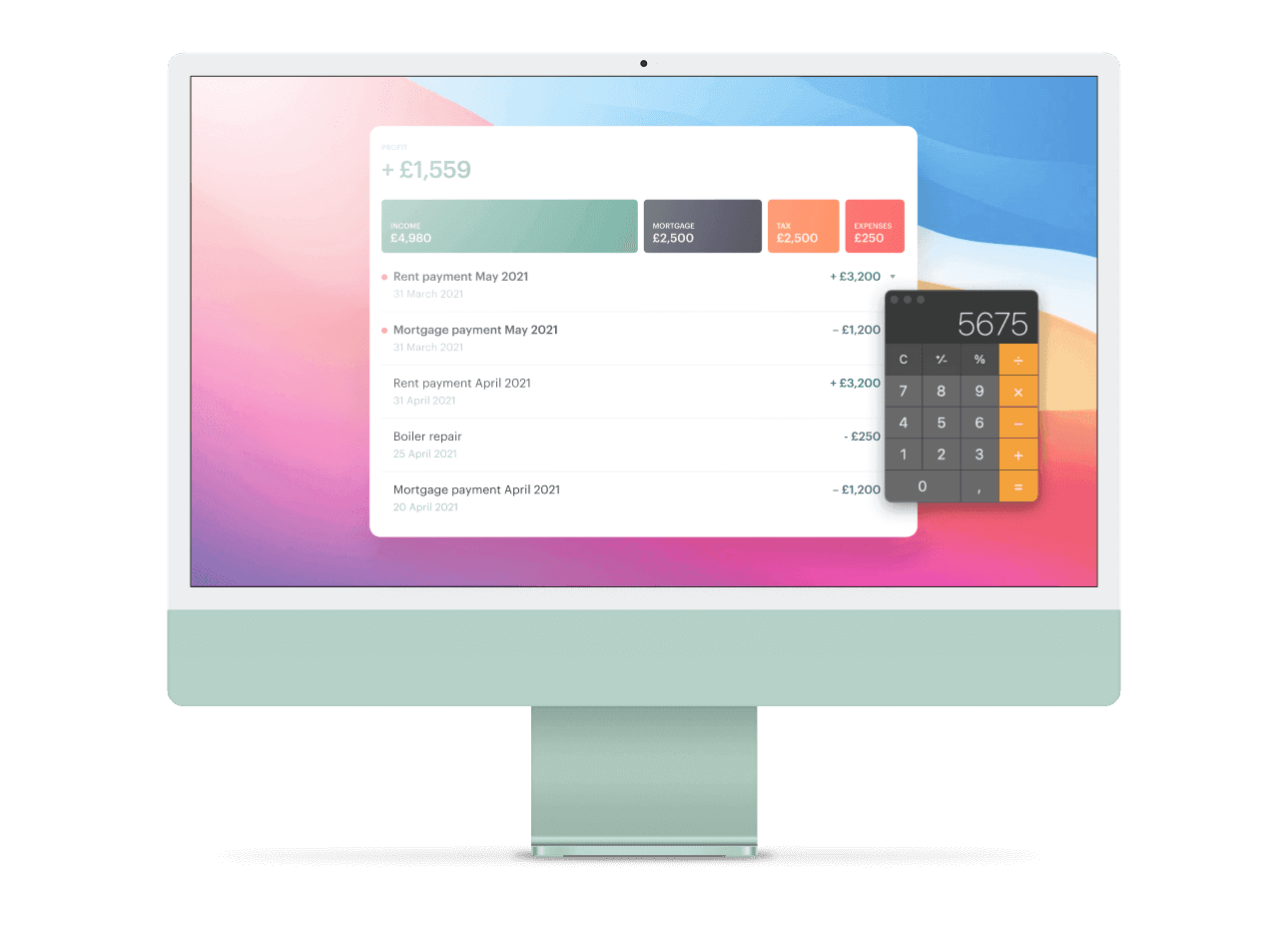

The way in which this can be set up with us is simple. Like the Rent Guarantee Insurance and Contents Insurance, you can easily apply to have your Home Emergency Insurance set up via our website. You simply purchase the insurance for a property you have listed with us, highlight the date you would like the policy to start, and we will send you the relevant documents you need to open your Mashroom account. Once we have all of the relevant information, we will put together your quote, basing the calculation on an assessment of your needs. With Home Emergency Insurance, there is a cut-off of funds that can be allocated. If the cost of the emergency is more than £1,000, any additional costs will need to be matched by the landlord.