While as a landlord you will need to fix issues of damp or rot, in most cases, as long as it does not harm the health and wellbeing of the tenant, this is not covered within your Home Emergency Insurance policy.

While infestations of common pests, such as rats, can be covered by your Home Emergency Insurance policy (check your personal policy to confirm this) what is not covered is the infestation of species such as bats, dormouse, birds, and badgers. The reason being is they fall under the banner of a protected species

We understand you need contractors and tradesmen you can rely on to carry out any necessary work that is required. However, these contractors would need to be vetted and provided by Mashroom. If you, as a landlord, hire your own contractor, this will not be covered within your claim.

As most Home Emergency Insurance policies simply cover the emergent incident itself, any issues that arise in the days following as a result of the emergency are generally not covered. There we would advise you to make any full repairs required after the original repair has been completed as soon as possible.

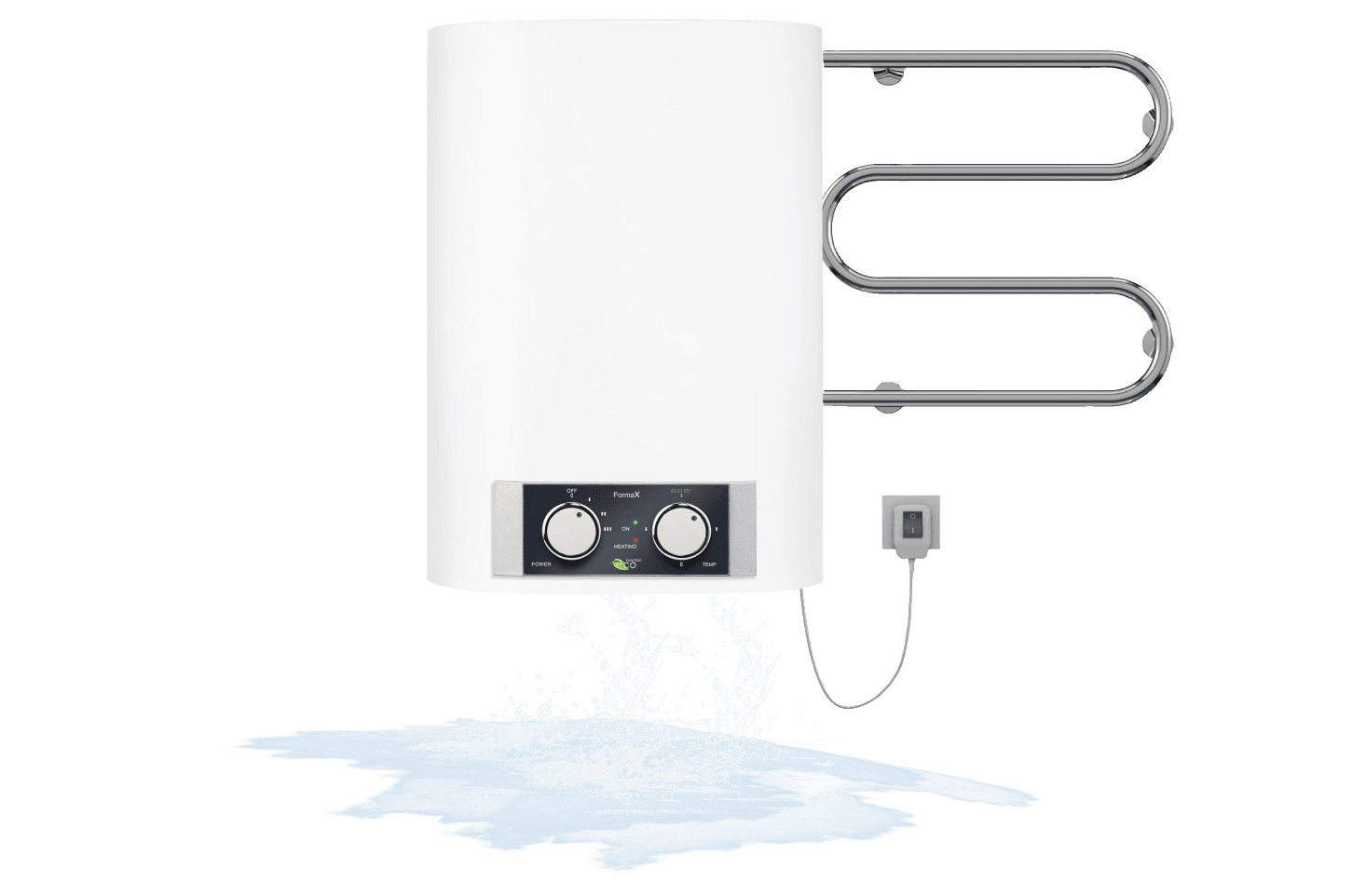

Home Emergency Insurance covers incidents that require immediate action only. Therefore, it is unlikely to be the most suitable for you if you’re looking for cover for certain appliances. For example, in the event of your boiler breaking, while parts of it may be replaced to get it up and running in the short term, we would not cover the cost for the entire boiler. As a general rule, the Home Emergency Insurance does not cover the breakdown of your appliances or belongings. For this, we advise your tenants to look at our Contents Insurance policy, which offers maximum protection.

When putting your policy in place, make sure you note down the date that your policy kicks in as you will not be able to make claims for incidents and emergencies that take place before your policy starts.

Please refer to our policy wording to find a full list of what is and what is not seen as an emergency as part of our Home Emergency Insurance Policy.