Your Guide to Tenant Referencing

Whether you’re a landlord or tenant, you will likely need to go through the referencing and credit checks stage after the initial offer is accepted on the rental property.

Landlords should carry out checks on tenants to see if they are suitable to rent their property, while tenants who go through successful referencing will stand a higher chance of qualifying to rent their new home.

If you’re new to the renting experience, you might be asking yourself what the referencing process entails. Fear not, though! In this guide, we’ll tell you everything you need to know about referencing and credit checks and what they mean for landlords and tenants.

What is referencing and credit checks?

There are several processes put in place to validate a potential tenant’s authenticity to rent a home. Typically, tenants need to earn 2.5x the annual rent to move into a property, and a reference and credit check will determine if they’re eligible.

When going through tenant referencing, tenants can be asked to provide:

- ID documentation

- Home address, to assess their credit file for any history of bankruptcy or CCJs

- Evidence of their Right to Rent

- Information about their employment or earnings to obtain a reference and assess affordability

- Details of their rental history to obtain a previous landlord or letting agent reference

Credit checks take place alongside referencing. These include:

- Debt and credit ratio

- Whether you’ve missed any financial payments

- Whether you’ve had any county court judgments (CCJs)

- Public records (are you on the electoral register etc?)

- Length of time at your previous address

The credit report provides a score that shows a tenant’s creditworthiness. The higher the score, the lower the risk from the landlord’s perspective. As a landlord, you don’t need to take reference or credit checks.

Everything you need to know about referencing

Who does reference checks?

How long does reference take?

How can I prepare for referencing?

Landlords

If you’re a landlord, you simply need to instruct the referencing company (or us if you’re doing it through Mashroom). They will get in touch with the renter and ask for the necessary documents. Then you sit back and wait for the results to come in.

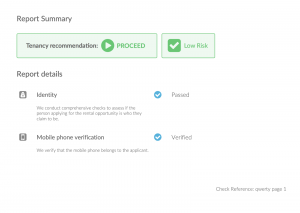

A typical reference check looks like this:

There’s a bit more to it. But you get the idea — it’s a thorough document that details everything you need to know about your potential new tenant.

Tenants

Tenants looking forward to moving into their new home stand the best chance of passing referencing and credit checks if they prepare. Get all of your documents in order, such as bank statements, proof of address and income and employment.

Being honest is also important. If you think you might not pass referencing, tell the landlord beforehand. Tenant referencing and credit checks aren’t the same as when you take out credit or a loan. The decision doesn’t lie with a computer. The landlord has the final say.

Landlords will appreciate honesty, and it will help get your relationship off to a good start. The checks will eventually reveal whether you’re suitable anyway. So being honest might work in your favour. Plus, the landlord can always ask for a guarantor if they want extra security.

Find out more about guarantors

The importance of referencing

Referencing is essential for landlords, especially as any failure to conduct professional references means they won’t be able to apply for insurance products like rent guarantee cover. Tenant referencing is also worth the peace of mind.

Tenants benefit from referencing as it proves their credentials as a high-calibre renter who is eligible to live in the property. Nowadays, it’s also possible to include rental payments in credit reports, meaning that tenants can build up a profile as an excellent renter.