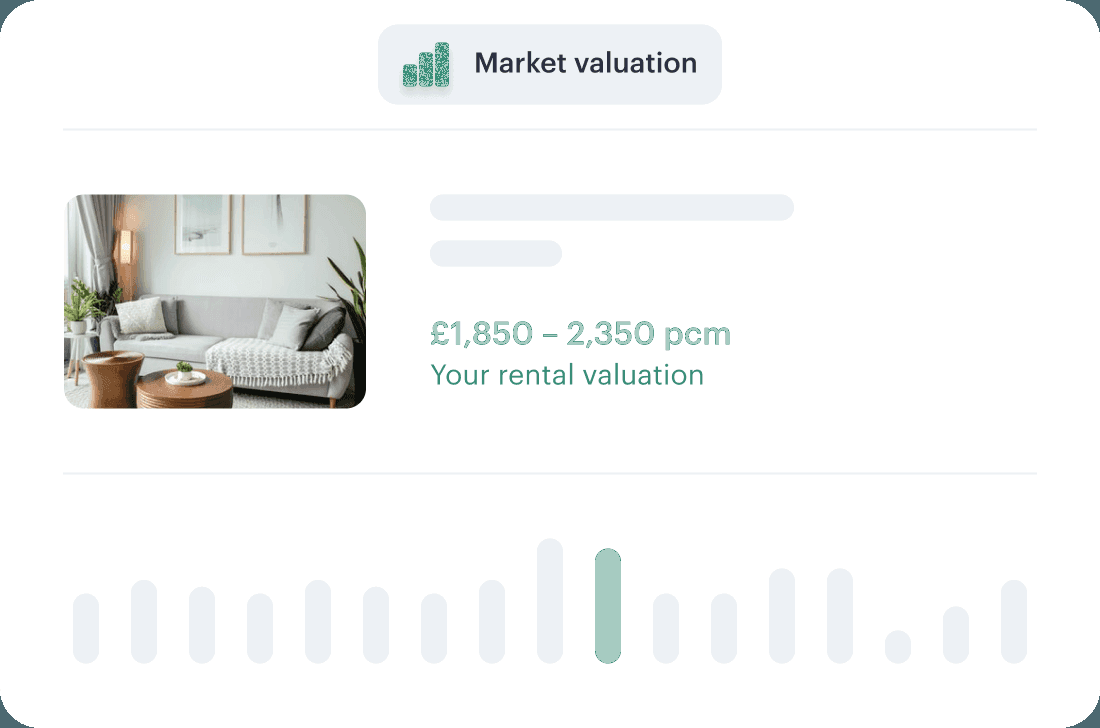

Market Valuation Tool

If you’re trying to decide how much rent you can charge when letting a property, use our Market Valuation Tool. Free, online and easy to use, this tool is a great way to get an idea of what sort of rent to set for your property.

Enter property details and get valuation

Simply enter a few property details like:

- Property type (a flat; studio; detached house)

- Number of bedrooms

- Furnished state

Then click ‘Get Valuation’.

Show results for similar properties in the area

Get real time results for similar properties listed in the area, including price, how many days they have been listed and view the listings on Zoopla.

Book a call to finalise valuation

Want your valuation finalised? Simply book a call with our lettings experts who will ask a little more information and help in giving you a more accurate, final valuation.

What is our Market Valuation Tool?

This online tool gives you a broad idea of the monthly rent you could be asking for your property. The tool looks at:

- The current rental rates of similar properties in the area based on its postcode

- Configuration, including number of bedrooms

- Whether or not the property is furnished

Why do I need a market valuation tool?

As a landlord, it’s important to set the right rental price for your property. It is always useful to know the going rental price for similar properties in your area. You don’t want to set your rent too low and short-change yourself on your investment. But, if you set the rent too high, you’ll find it difficult to attract or retain long-term tenants. They’ll soon find out what their neighbours are paying…

It’s all about what your property is worth to the people who want to live there. And that largely comes down to location. Letting property in London might mean a high initial investment because of the inflated property prices, but you should be assured of a steady rental yield because of the continuous demand.

Get started with your next property rental

Whether you’re becoming a landlord for the first time, or you are already successfully renting a number of properties, there are many ways Mashroom can help. From getting a rough estimate of what rent you can expect with our Market Valuation Tool to finding suitable tenants and managing your property, we will ensure your next property rental is a success. Book a free 10-minute landlord consultation with our team today, and find out how we can help you best.

Join Mashroom for