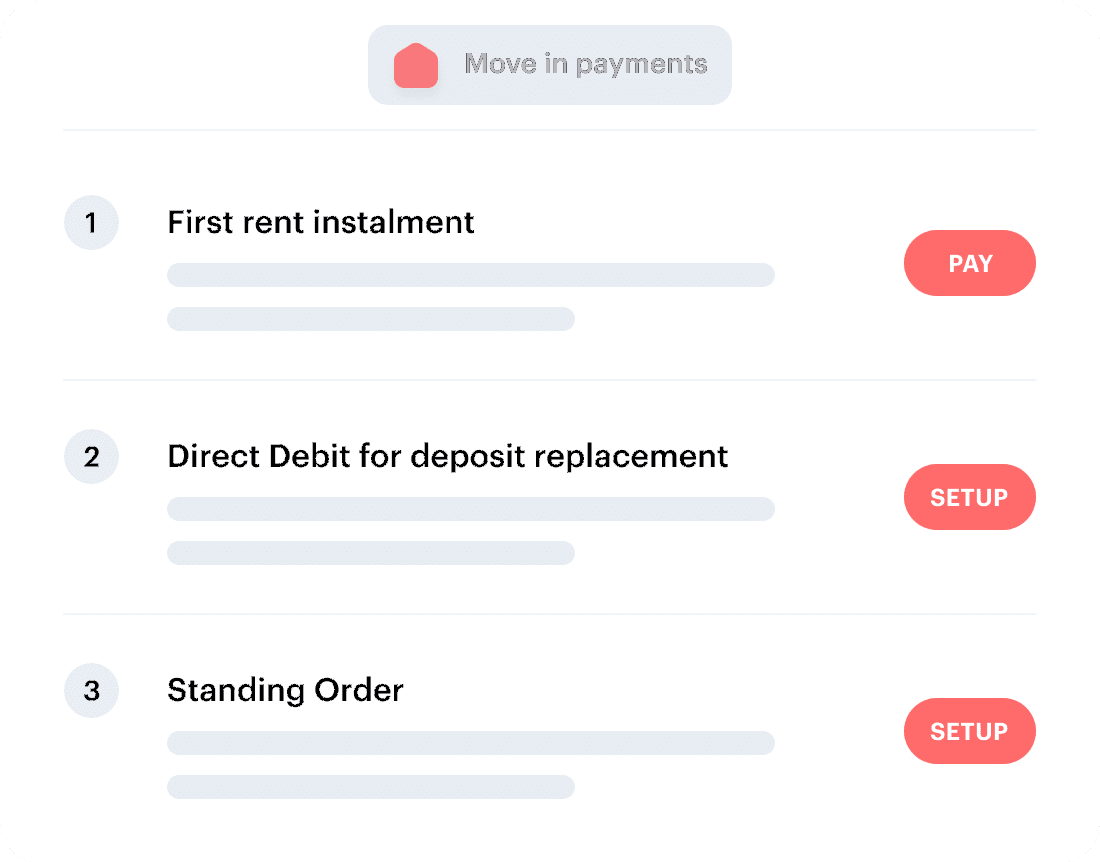

Our Deposit Replacement scheme allows you to move in with our the have the 5 weeks worth of cash normally needed for a traditional deposit. Instead of the landlord asking for a lump sum deposit when you move in, we will help you pay the money, equivalent to one week’s rent (+VAT).

A security deposit protects the landlord against damage to their property, and against the tenant withholding rent. However, the burden of finding hundreds of pounds or more to hand over is sometimes unrealistic for the tenant.

The Deposit Replacement will spread the burden over a manageable timeframe. However, it is not a tenancy deposit protection scheme. The one week’s rent that you pay is non-refundable and you will be liable for any damages to the property during your tenancy. Any deposit disputes will have to be sorted between the tenant and the landlord as normal.