A Guide to Rental Yields

As a landlord that has most probably decided to enter the buy-to-let property market, your priority is to determine whether your investment will be sound and worthwhile, in addition to having a clear understanding of what your return on investment will be.

Rent Guarantee Insurance for £299

- ✓ Covered for £2,500 per month

- ✓ Claim up to £25,000

- ✓ Free access to legal advice

A very useful reference point in understanding and navigating the buy-to-let property market is the rental yield. In calculating it you are able to see whether the rent that you will be charging in addition to other expenses (e.g. mortgage payments, maintenance, etc.), will be financially profitable.

In a time where rental prices for given areas and property types are readily available online, you are given the amplest opportunity to set your investment and property up for success and can do so through the use of the rental yield calculations and statistics to corroborate your investment.

How to measure rental yield

Rental yield is a measure of the return on a property investment, which is affected and calculated by a number of factors including the property price, interest rates on your mortgage, rental rate, but also the demands and necessities (i.e. maintenance cost) of your tenants.

In calculating rental yield, you are directly comparing the value of the monthly rent charged to that of the property price, and as a rough guideline, anything above 7% rental yield is considered to be a sign of a great investment for a buy-to-let property.

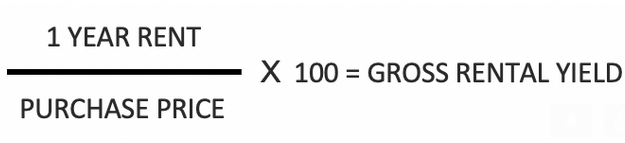

Calculating rental yield is essential to understanding how it functions, and can be done in two ways, either through gross or net rental yield. To calculate gross rental yield, you divide a year’s total rent by the purchase price of the property in question and multiply that figure by 100.

As an example, if you were to acquire a buy-to-let property for £350,000 and receive £1,300 a month in rent, generating an annual income of £15,600 (12 x £1,300), then the gross rental yield is (15,600/350,000) x 100 = 4.46%.

Though as can be seen, gross yield is a relatively simple calculation, no extra costs are taken into account, which could potentially include mortgage payments, insurance, or simply general maintenance of the property. These however are essential to consider when trying to ascertain whether a buy-to-let property could provide you with sufficient return on investment.

A significantly more useful rental yield measurement which takes into account the additional expenses mentioned above such as mortgage repayments, maintenance, etc., is net rental yield.

Net rental yield is calculated by taking the annual rental income, minus the costs associated with owning the property. This number can then be divided either by the property value or the initial money put forward for the house payment (i.e. the full house price minus the money borrowed through the mortgage), which will give us two different results, that are useful in their respective ways.

Different methods of measuring rental yield

Method 1 – using the property’s total value

Method 1 involves dividing by the property value can be described as follows: you buy a £220,000 property with a £165,000 buy-to-let mortgage at a fixed interest rate of 3.12%; you will repay your interest at £429 monthly or £5148 annually.

If the monthly rent is set at £920, the annual rent you would come to £11,040. The additional costs will usually be around £380 for insurance, £950 for essential repairs, and £830 for void periods bringing it to a total of £2,160. This means that the net rental income will be (£11,040 – (£5,148 + £2,160)) which comes to £3,732, with net rental yield being (3,732 / 220,000) x 100 = 1.70%.

Method 2 – using just the deposit you paid for the property

Method 2 is very similar in the initial calculations that give us the figures for the annual mortgage repayment (£5148), additional expenses (£2,160), and net rental income at (£3,732).

However, instead of dividing the figure by the full value of the property as seen in the first method, we are now dividing it by the capital outlay (i.e. the difference between the value of the property and that of the mortgage), which in this case is £55,000. Thus, this gives a net rental yield of (3,732 / 55,000) x 100 = 6.79%

The choice of rental yield calculation will largely depend on your application of the figure. If for instance you are looking to compare the best options for purchasing a buy-to-let property in different cities or areas (e.g. with a fixed budget of £250,000 you compare different property options), then looking at the rental yield derived from the property value is very useful.

If, however you are looking to compare a buy-to-let property purchase to other investments such as bonds or stocks, then using the second method which considers your capital expenditure is more relevant.

How to maximise your rental yield

Now that you have an understanding of what rental yield is, how it is calculated and what it is useful for, it is worthwhile knowing what strategies you can use to maximise rental yield. While some factors are beyond your control (e.g. mortgage interest rates, tax, property market shifts), there are a handful of methods you can apply to maximise the rental yield of your property.

Increasing the rent is an obvious strategy for increasing rental yield and can be applied if for instance your current rent rate is lower than the market rate.

Although on a fundamental level this strategy may seem contradicting, lowering your rent could also increase the rental yield. If the rent rate is higher than that of other property in the area, by lowering the rent you could decrease or terminate the void periods in your rental income.

By improving the property interior and facilities will attract a greater volume of tenants, and simultaneously be able to charge higher rent, which will contribute to a higher rental yield.

Finally, minimising the costs of maintenance of the property (e.g. finding a cheap handyman) or remortgaging to a better loan deal can also aid in improving your rental yield.

What is a good rental yield?

A good rental yield will naturally cover the annual running costs of the property discussed above, and in an adverse case you will find yourself paying out of your own pocket more frequently than you would like to, leading to financial loss.

As a property investor, the sweet spot for a rental yield is in the 5-8% range, which will allow you to cover all of your additional expenses, whilst also making a reasonable return on your investment.

The UK’s top hotspot for property investing currently is Middlesbrough with a gross yield of 7.7%, and although London has some of the highest rental rates in the country, the extortionately high property prices offset the rental yield to a low maximum of 5.3% (Barking and Dagenham).

Property investment, just like all other investments is not risk averse, and although thorough research can set you up for a return on your investment, property vacancy for instance can very quickly void your previous and projected earnings. However, a good understanding of the market and its trends as well as critical evaluation of property with the use of rental yields, will often prove rewarding.