Livestock, Whisky or Handbags: Where are the smart investors putting their money? [Part 1]

Looking for an investment opportunity that isn’t just numbers on a screen? Stocks and shares can seem a little dull, and frankly there’s more return out of storing your cash under the bed than in most traditional banks these days

Rent Guarantee Insurance for £299

- ✓ Covered for £2,500 per month

- ✓ Claim up to £25,000

- ✓ Free access to legal advice

So where does the savvy investor turn when they’ve capital to spend, and a fancy for fun? We’ve identified our top ten investments – we’re going to run through the top five today (part two coming tomorrow)!

Whisky

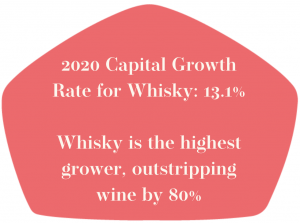

Investing in wine is nothing new. Laying down a bottle of your preferred vintage has been a pastime for a while, and still has its charm. However, savvy investors have moved on to the hard stuff, with whisky taking its place at the investing bar. And it’s not hard to see why, according to Elite Wine and Whisky, the annual capital growth rate for whisky in 2020 was 13.1%, with research from the Luxury Investment Index 2020 showcasing it as the highest grower, outstripping wine by 80%.

You tend to buy whilst your whisky is still maturing in the cask, with opportunities to sell at any time. You don’t have to store huge rolling barrels of amber nectar, it’s all housed safely with the distiller, ticking away for you and making you a tidy profit.

This can be a tricky business to navigate on your own, however there’s plenty of whisky-specific investment houses available to help guide you through the process. Most have a minimum deposit, but are on hand to suggest tips, trades and online exchanges. Cheers!

Jewellery

Everyone loves something sparkly, but clearly a bit of bling isn’t just ideal to adorn you in the here and now. Strategic investing in the right set of jewels can be a really smart move, and one of the prettiest ways to boost your portfolio!

Not any old bauble will hit the spot though. All that glitters is not gold standard in an investment world. Of course, anything with a high weight of precious metal, gold or platinum will have a hefty value. There’s no doubt that a gold bar would have a higher value than an ornate ring, but not quite as fun, is it?

The real hike with jewellery comes when you add precious stones. Whilst many people gravitate towards diamonds as the stone of choice, they are not actually the most efficient investment, according to AJS Gems. To make the best return, you want to be searching for great quality rubies, blue sapphires, emeralds, spinels and Tsavorite garnets, all of which have a great history of increasing in value over time.

Keep your eyes peeled at car boot sales and antiques fairs, where you can often strike lucky with some fantastic vintage finds for rock bottom prices – often older jewellery has brilliant quality stones and unusual settings, all highly sought after by savvy investors.

Art

Art is hugely subjective, what makes one person gasp in wonder can make another shrug in disdain. However, unlike some of the other items on this list, we feel that art is one thing that you should be a little bit passionate about – it’s created to be displayed, and even if you’re buying as an investment, it seems a shame not to display the piece! Finding something you love is key, it’ll help you keep it long term, allowing it to do it’s best to build in value for you.

Of course, falling in love with something isn’t enough to guarantee that something will make you millions. Keep your eyes peeled for pieces by emerging artists, or small pieces by well known names, and always make sure that whatever you buy is signed by the artist!

Keep your ear to the ground at local art fairs, and even art colleges for emerging talents.

Livestock

Yes, really. Actual livestock. And don’t worry, you don’t need hundreds of acres and a penchant for early mornings to make this one work either.

You could start small. Honey-bees are a popular investment. An active hive may not give you a huge return, but it will give you a super sweet one, and you’ll be hugely popular around hay-fever season. Alternatively, you could go for something slightly heftier…

Livestock investing is a simple way to help farmers around the world grow and maintain their assets, until they’re ready for market. You buy the young asset, either livestock or plants if you prefer, and the farmer takes great care of it, until it is ready for sale. At this stage, the farmer buys the asset back, and you profit from the sale.

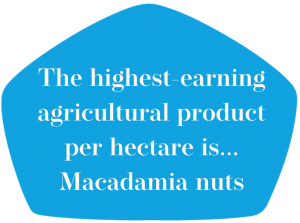

Whether you are looking to invest in beef, dairy, or the highest-earning agricultural product per hectare, Macadamia nuts, this investment opportunity not only delivers you a healthy profit, but also gives a leg up to farmers who need working capital.

Property

An old favourite, investing in property doesn’t fall out of favour for a reason. With more people than ever choosing to rent, it is no surprise that the demand on the private rented sector is continuing to climb.

Here at Mashroom we like to support at every stage of their journey, and our free advertising platform can help simplify finding a tenant, but there are still plenty of things to consider before you take the plunge into property.

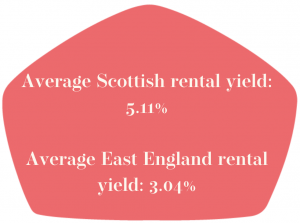

Rental yields vary wildly across the UK. Scotland has the best, with an average of 5.11%, whereas the East of England is by far the worst, with returns looking at just 3.04%. Making sure you invest in a smart location, allowing you to make the most of this burgeoning market is key to opening the door to property profit.

So, there you have it – five exciting investment opportunities that are a little different to the norm. We’ve got five more up our sleeve, so keep your eyes peeled for our next instalment!

As with all investments, even the most stable option can go down as well as up. We urge you to take your time before you choose to invest and consult with experts wherever necessary.

Happy investing!