The Gold Standard: Is there a level playing field for disabled renters?

Going for Gold!

Despite being delayed by a year, our Paralympians stormed into second place on the Paralympics 2020 scoreboard with 124 medals – 41 of which were gold. This event is one of the best examples of inclusivity in the world, allowing people with a multitude of disabilities, from blindness to impaired muscle power, to come together and compete at the highest level.

But are our Paralympians coming home to gold standard accommodation?

We all know that the world is designed for the able-bodied – from narrow doorways and corridors to sinks too high for use in wheelchairs. But we can all agree that we want to live in a world where accessibility for those less able-bodied comes as standard. From dropped kerbs and tactile paving, to wider aisles and doorways, there are many physical changes we can make that will go almost completely unnoticed by able-bodied users, but will make life much easier for the disabled and, more importantly, will make them feel seen by their community.

Japan leads the way

Japan leads the way

Japan has led the way with their innovative Paralympic Village, which has been designed for ease of use by the Paralympians with :

- barrier free access

- closets designed for wheelchair use

- and stairless boarding for the internal shuttle buses

When it comes to renting, things become more tricky. As a landlord, it’s your responsibility to ensure that the property you are renting out is clean, safe and fit for purpose. But do these standards only ensure easily available rental options for the able-bodied?

At the moment, there are no legal requirements for landlords to make their properties accessible to all – so it comes down to the ethics of the situation.

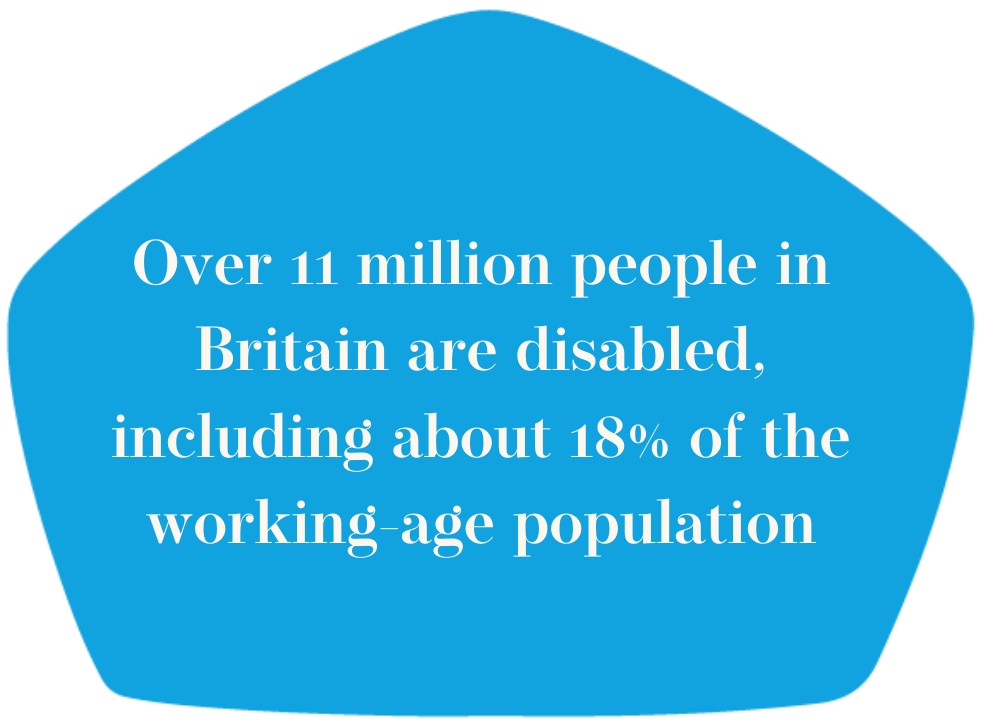

Disabled people make up around 10% of the global population. Over 11 million people in Britain are disabled and that includes about 18% of the working-age population. By not making your properties accessible for all, you are rejecting the needs of a huge proportion of the British population.

While landlords aren’t responsible for the buildings their properties might be in, there should be a movement towards ensuring that all new buildings have lift access and easy to navigate corridors. Not only does this significantly increase the number of homes available to disabled people, but will also help people in the buildings who may need more accessibility due to accident or illness after they’ve moved in.

A warmer welcome

So how can you make an accessible and adapted property ?

Bathrooms are also places where you can make small updates that will make the world of difference. Showers are often easier to use for disabled people than baths, so be sure to have a walk-in shower if possible, as well as grab rails.

If it’s possible to swap front steps for a slope, this is also a quick win!

The Disabled Facilities Grant is available from local authorities in England and Wales to help make changes that will help disabled people stay in their homes, so it’s worth speaking to your local authority to see how they can financially support the changes you want to make. These changes include widening doors and installing ramps; building or adapting bathrooms and bedrooms; adapting heating and lighting and providing ease of access to outdoor spaces.

These are all things that you should really highlight in your images and in your write-ups about your property when looking for new tenants. These are things that the people who need them will really be on the hunt for, so make it easy for them to find you!

Also, be open to having a chat about the property on the phone before a first viewing – the prospective tenant will know exactly what they need, so it’s quicker and easier for them to check that over the phone and save a potentially wasted journey.

A variety of needs

A variety of needs

However, it’s worth bearing in mind that not all disabled people are wheelchair users. Disability and people’s experience of their disability varies widely, so while you can make these changes to open your home up to more people, you cannot make it right for everyone.

We would really encourage you to talk to potential tenants about changes that will make their lives better and easier in your property. It could be that a small outlay on your part will significantly impact your tenant and a happy tenant makes for a happy landlord. And don’t forget to ask your Local Authority for support – you never know what grants might be available to you and your tenant!

You should also consider the possibility of something happening to your current tenant. Accident, new diagnosis or the advancing of an existing illness could mean your property is no longer quite right for them. But the answer doesn’t have to be that they move out and find somewhere better suited. Talk with your tenant – it could be that something very simple from your end would really help them and you wouldn’t lose a great tenant.

Disabled people are a vibrant and active part of our society and they deserve as much access to great homes as anyone else. We need to become more mindful of the needs of the wider population and not just celebrate it every four years.