What Happens If Your Tenant Is In Breach of Contract?

As a landlord, one of the most important things about a tenant is that they will respect and uphold all of the clauses of the tenancy agreement.

Rent Guarantee Insurance for £299

- ✓ Covered for £2,500 per month

- ✓ Claim up to £25,000

- ✓ Free access to legal advice

It can be seriously frustrating and costly to deal with tenants who breach the terms of their assured shorthold tenancy, so trust is a really important factor when you’re taking someone on.

However, if you do have a tenant who breaks their contract, then there are a number of actions you can take to successfully deal with the problem. This is thanks to property laws and tenancy rules, which make the process of dealing with deviant tenants a lot more straightforward.

We’re shining a light on the many possible solutions for landlords who are dealing with tenants in breach of contract. Keep reading for everything you need to know.

The tenancy agreement

The good news for landlords? Both the landlord and the tenant have to sign a tenancy agreement prior to the start of an assured shorthold tenancy; this document is legally binding.

Regardless of whether your tenant has actually read all the terms and clauses within the contract, they’re contractually obliged to uphold every part of the agreement.

In most cases, tenants will be aware of their rights and duties and stick to them. However, at times, a tenant’s actions (or lack of action) can result in a breach of contract.

Breaches of contract

There are a number of ways a tenant can breach their contract. The most common breaches include :

- anti-social behaviour (such as being too noisy)

- failure to pay rent

- smoking

- property damage

- keeping pets without permission

Tenancy breaches can also involve criminal activity on the premises of the property including : repeatedly denying your landlord access to the property ,sub-letting if the tenancy agreement prohibits it and any other clause within the contract that restricts the tenant’s actions.

Of all the possible breaches, the most common is failure to pay rent, thereby creating rent arrears. In this case, the landlord is expected to give the tenant an opportunity to repay their debt.

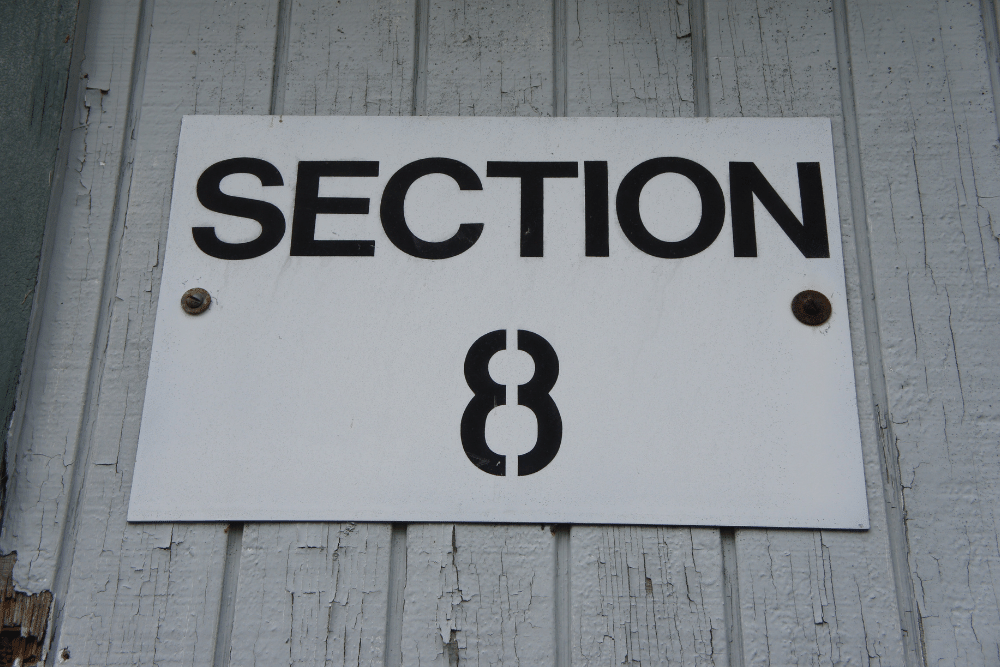

However, if all appropriate measures have already been taken, and the tenant still fails to pay rent, then a landlord is free to serve a Section 8 Notice. A Section 8 Notice should — result in a court order for eviction of the tenants and repossession of the property.

Giving notice

As mentioned, once one or multiples clauses of the tenancy agreement are breached, the landlord is able to issue a Section 8 Notice. If approved by the courts, this will result in the landlord receiving a Possession Order, allowing them to evict the tenant and repossess the land.

The Section 8 Notice works as a formal communication of the tenant’s breach of contract; it involves the landlord filing the appropriate paperwork and preparing a witness statement for the court to consider.

Alternative solutions

There are a number of alternative routes if you’re willing to compromise on the issue at hand and keep your current tenants. Finding new tenants can be time-consuming and costly, so it’s not always in the best interests of the landlord.

If the breach of contract isn’t too serious, you can try dispute resolution or mediation instead of issuing a Section 8 Notice.

Alternatively, if you choose to take no action against your tenant and wait for the tenancy to end, then it’s in your interest to serve them a Section 21 Notice : This lets your tenant know that they won’t be able to renew their contract and will have to vacate the property at the end of their term. Currently, due to the coronavirus pandemic, this has to be done 6 months before the end of the tenancy.

Ultimately, if you’re mostly happy with your tenants, but they’re in breach of the terms of the tenancy agreement, then direct communication to resolve the problem without legal action is probably the best way to go. This could save you both a lot of time, money and stress in the long run.

Getting a better outcome

All in all, while a contract breach is always going to be inconvenient, it doesn’t have to be a total disaster.

Thanks to your legal rights guaranteed by the contract, as well as the many options for resolving the problem, you’ll be sure to get up and running again in no time, with or without your troublesome tenants.