What Valid Expenses Can You Claim On Your Tax Return? – April Tax Webinar Transcription

Introduction

Naveen Jaspal: So first of all, welcome. So quick introduction to us all, I’m Naveen Jaspal. I’m a landlord just like most of you on the call today. I’m the COO of Mashroom.

Chloe Greenbank: Good afternoon, everybody. Nice to be here with you. My name is Chloe Greenbank. I’m from Rotherham Taylor. We are a firm of chartered accountants looking after lots of landlords and property businesses.

Simone Brown: Hi everyone. I’m Simone. I’m the tax manager at Rotherham Taylor. I’ve been in this game for quite a while now. My life mission is to make sure that everybody is paying the lowest amount of tax reasonably possible. So hopefully you’ll be able to pick up some good hints and tips today.

NJ: Is that reasonably and legally possible, Simone?

SB: Yes, definitely. We always want to play legally Naveen!

NJ: Okay. So just to explain what we talk about today so you all have the agenda. The first thing that we will be looking at is just an introduction. Who are Mashroom? Because a lot of you have joined the call, so it makes sense for you to understand why we are even doing this in the first place.

We are going to talk about how taxes are calculated on rental income, what expenses you can claim for, what is inheritance tax and how will it affect you, or how could it affect you. A lot of people are interested in, should you look at moving your properties into a company? We will have a Q&A section which will be live at the end. And then we’ll talk about how Rotherham Taylor accountants can go on to help you. So getting started, why are we even hosting this in the first place?

My view as a landlord is, it’s so complex. The landlording world has become more and more complex as time goes by. And I felt and I saw others that we only ever had the opportunity to learn through bad experiences, and I want to try to help us all optimize our rentals and help you avoid the cost and mistakes that I’ve made and others have made.

So we can have this as a forum for education, but also we can all start sharing our experiences. I also think it’s really unfair that as landlords, we do feel like we are cash cows. We recently did a poll and 75% of landlords all felt that the government would just using us now as cash cows and then secondary to that, a lot of people perceive us as unscrupulous money-grubbing landlords.

And the truth is that actually we’re just decent people providing great housing, and we are actually trying to continue to remain profitable in an ever-changing world.

And then if we have a look at profitability. Well, how do we remain profitable? Well, the first thing is through taxes. So one, that’s why we’re holding this webinar. We know that taxes outside of the normal day-to-day costs of running a property are the most expensive annual bill that we’re all receiving at the moment.

So let’s understand the intricacies of this, what’s claimable, but also how is tax now calculated given the recent changes, and we all need to know how to protect our assets in the event of our deaths. And that might sound quite a dramatic thing to say, but as a landlord, I know that I certainly want to make sure that our families are able to benefit from our investments rather than burdens for them in our passing. And we’re all knowledgeable professionals here, professionally, in whether landlording is our main career or our secondary career.

But as professionals, I think we need to start looking at how we don’t rely upon third parties and how we can rely upon ourselves, and that’s through the knowledge and education. And we need to be able to give you access to all the people who can help you along your journey, and we need to find more cost-effective ways.

So is that a case of finding a way not to pay so much tax? Is there a way that we can cut down on our monthly payments? Are we losing a percentage of our monthly rent that we might not need to move or lose if we knew more or understood more about the marketplace? So that’s what we’re trying to achieve by holding these webinars for you. So without further ado, it’s over to you, Simone.

“After I’ve made money on my rental property, how do I know how much tax I’m going to pay?”

SB: Thanks Nav. So one of the biggest things everyone wants to know is after I’ve made money on my rental property, how do I know how much tax I’m going to pay? So I’ve done a little example here. It is only a very basic example, but we’ll run through how you would calculate the tax that’s due.

If you are either an individual landlord or you are running your properties through a company. So the very basic calculation will be the same in both instances. You would start with the income that you’ve generated for the year. You would deduct your allowable expenses, and that would bring you to a profit figure. Now, as you can see at this point it’s worth noting that due to the changes in the finance charge rules from HMRC, individual landlords can no longer claim an expense deduction for mortgage interest on residential property.

So whereas a company would get an expense deduction for that, an individual landlord wouldn’t. So you can see that an individual and a company will derive different profit figures at the first calculation stage. Once you calculate the profit for the year, an individual would multiply that by their personal tax rate. Now for most of us, this is going to be 20% or 40% for those of us that are extremely higher earners, it could go as high as 45%, whereas for a company, would always pay a tax on the profit at a flat rate of whatever the corporation tax rate is at the time.

So that’s currently 19%. I’m sure a lot of you are aware from the budget announcements a few weeks ago that the rate is due to go up to 25%, but there is a small companies rate which will still be set at 19%.

So just because of the rates due to go up, doesn’t necessarily mean that it will go up for everybody. So for an individual after you’ve multiplied it by your relevant tax rate, this is where you would get the relief for your mortgage interest. So you would just get a flat 20% tax deduction. So if you’re a basic rate tax payer, so you’re paying tax at 20%, it’s effectively the same as treating it as an expense in the first place.

And you would come out at a tax payable figure at £600. Whereas if you were 40% taxpayer and you’re only receiving tax relief at 20%, you can see from the example that you would have a substantially higher tax liability.

So it’s in these sorts of cases where you might consider changing the way that you’re holding your properties. Of course this is only the tax that’s due on the rental income. If you’re operating through a company there would be additional taxes due for you to take money out of the company. But this is just a good idea of what the basic calculation would be. As you can see the biggest deduction in most cases for people, apart from mortgage interest will be your expenses. So now it’s just going to run through an example of what some typical landlord’s expenses might be.

NJ: So to give you an idea, this varies regionally, and up and down the country, but what we’ve looked at is typical landlord expenses. So if you have a property value of about 250,000 you know that you’d have to put down a 25% deposit for a buy-to-let mortgage. So your mortgage has put 62,500 into the property.

Your monthly mortgage payment, and I should make the point that this would be an interest-only mortgage payment is likely to be around £250 a month. And your annual rental income is probably about £1,000 a month, making it £12,000 annually. So what expenses on this type of property could you be expecting? Well, okay. Annually, we’re looking at £3000 interest-only mortgage payment.

If you look at insurances, that’s around £420, and these are things that we just can’t change. They’re standard, that’s well out of our remit.

“How can I save money as a landlord?”

However, let’s try and look at the costs where we can start to help you to save some money. So the first thing is repairs. So the average property will require about £600 annually spent on it, some more, some less. But the difference is with Mashroom, we can help you save that money because we are not going to take an uplift upon your repairs.

So rather than being £660 by the time you’ve calculated it, it’s likely to be 600. We look at referencing costs and that’s really the size of the price. So we know that there’s been a tenant fee ban and what’s happened is the cost of referencing and the cost that a tenant would have been paid is now been put on to you as the landlord.

So I’ve heard of many landlords recently, and the average that people are paying for referencing was about £100 per tenant. So if you have two tenants, you’re likely to have to pay £200 in reference fees. At Mashroom, we’ve decided that actually we’ll give you the true cost which is £15 per reference, so it becomes £30.

So there’s a really big saving there. But the size of the price and the size of the saving gets much bigger when you consider a tenant find fee and a management fee. So at Mashroom, we don’t charge for either of those. Why? Well, because we are able to advertise you for free on Rightmove and Zoopla, but also we let the portals, the Mashroom platform, help you with your management. So in total, the saving with Mashroom, using our service, it’s going to save you £2,279 annually.

So we’ll just have a look at this in a graph format just to make it a little bit simpler. You can see on the left-hand side here, all of your costs that you’re likely to be paying and how Mashroom can help you reduce those. Now, I don’t know about yourselves but I quite like the idea of saving £2,200 every year.

And some people that will become far more, if they are charging more than £1,000 a month on their rental. You mix that with the ability to understand your taxes, your saving can go into the thousands. So now we understand that if we then move on to the expenses part. So Simone I’ll hand back to you.

“What expenses can I claim for as a landlord?”

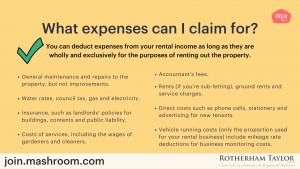

SB: So the question that I get asked quite often is, so what expenses can I claim for? Now, I’ve been a bit cheeky and I’ve actually pulled this list straight from HMRC’s website. So you know that this is definitely the list of expenses that you can claim for.

The golden rule to always ask yourself is, are you paying for something because of the rental property or because the rental property needs it? If the answer to that is yes, then you’ll meet what’s known as the wholly and exclusively test, which is the top line on this slide which again has been pulled straight from HMRC’s guidance. So I’ll have a quick run down the expenses. I am going to cover them all quite generally. So if you do have any questions, if you can pop them in the Q&A box and we’ll try and answer as many as we can.

So the big one maintenance and repairs to your property, but not improvements. So if you are bringing something back up to its original standard, if you think painting and decorating, fixing a leaky tap, things like that, that will be costly to repair.

But if you’re improving something beyond its original standard or putting in something that wasn’t there before, that will be classed as an improvement. And for improvements, you can’t treat those as an expense against your rental income.

Those would be treated as improvements that you would offset against the cost of your property when you come to sell it. Another one, water rates, council tax, gas and electricity. Now in most cases, your tenants will probably be paying these costs themselves, but if you’re renting your property bills included, or you’re covering the cost of these bills between tenants.

That’s definitely something you can claim for as long as if you are between tenants, you are intending to let the property again. It can be slightly different if you think that you might sell and then change your mind. Insurance, as long as it relates to the property again, so one more, it’s policies for buildings, contents, and public liability.

Costs of services, so if you have someone that comes out to cut the grass once a month or a window cleaner that comes around every few weeks, that does relate to the properties. That’s fine. Accountant’s fees, obviously that sets up the what we are here for, to advise you on the rental properties. Rents, if you’re subletting or ground rents, if you don’t hold the free hold for the property and service charges.

A smaller one that many people don’t realize they can claim for things like telephone calls. So if you’re making frequent calls to arrange repair work, perhaps, or your chasing tenants for outstanding rents, you can claim for those. Stationery and obviously advertising for new tenants. Another one not many people know about, vehicle running costs, but you can only claim the portion that you used for your rental business.

So generally what we would say in this situation is keep a log of the mileage that you’ve done of journeys relating to the rental properties, if you have to visit the property to do an inspection, or you have to drive to the suppliers to pick up materials for repair work, and then you could look at claiming the mileage rate for the year, or possibly a proportion of your overall motoring cost. So that was what we can claim for.

Obviously it wouldn’t be fair unless I told you what you can’t claim for. Again, these are pulled straight from HMRC’s website, so you can’t get any better guidance. So you can’t claim for the full amount of your mortgage payment. I think most of us know this already, but it is only the interest element that’s allowable.

But what I would say is, it’s not just a mortgage that you can claim the interest on. You can claim it on any additional finance charges. So if you’ve got funding that isn’t a mortgage, it doesn’t necessarily mean you can’t claim the interest.

Private telephone calls, so this links back to telephone calls that were allowable, is only if it relates to the property. So you couldn’t claim the cost in full of a monthly bill, for example. Personal expenses, I’m not sure how stupid HMRC think we are, but I don’t think anyone is just going to go out and claim something that is clearly a personal expense.

Finally, a bit of a grey area, clothing, HMRC really loath going into claims for clothing. What they say is it needs to be protective in nature, or it needs to be part of the uniform. So unless you’ve got a lot of properties where perhaps you might need uniforms to show that you are from your business, probably not going to make a claim for that. I know that this is something that Nav’s thought about.

But you could potentially claim for overalls, maybe if you’re doing some painting, HMRC could try to argue that you could take those overalls home at the end of the day when you finished and use them to paint your own house.

I’m not sure they’re going to open an investigation for something so small, but it’s just to make you aware that it’s a bit of a grey area. If you do want to look at the full list of examples of expenses, there is quite a good list on HMRC’s website and they do have proper examples that you can read through. But as I said, if you’ve got any specific questions, just pop it in the Q&A. When it comes to expenses though, Mashroom is quite good at helping you handle these. So Nav’s just going to show you how the dashboard works now.

NJ: Okay. So one of the biggest frustrations that I’ve had as a landlord is trying to keep a track on all of my expenses as I go through the year. So that’s something that we thought about when we built Mashroom as a platform. So if you all join, join.mashroom.com, we’ve actually made a dashboard available to you all. And it’s a live dashboard, and you’ll be able to see on there that you can keep a link to all of your expenses. So you can see on here, number one, it’ll calculate it for you.

So it’ll calculate what your mortgage payments have been, what your income has been, and also your expenses as an overall total. But it’s very easy. If you have a look on the screen and there’s an add expense button, that will allow you to add your expenses and store your receipts. The functionality is so near to coming now where hopefully very soon, you’ll be able to download your expenses in one sheet, and you’ll be able to send those over to your accountants.

So it’s really important. We couldn’t keep hold of our receipts, but through Mashroom is really easy to get hold on to them. We move on next, now this is the inheritance tax side, Chloe.

“What is inheritance tax? And how does it affect me as a landlord?”

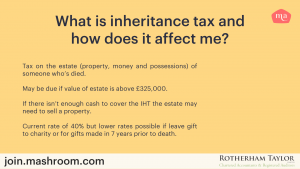

CG: Over to me for the doom and gloom! No, hopefully not. So what is inheritance tax? And how does it affect me as a landlord? Well, inheritance tax is the tax on the estate of someone who has died. And most of a person’s assets will go into your estate, including your rental properties. If your total estate is under the nil rate band which is currently £325,000, there is no inheritance tax to pay. Happy days.

Also if all of your assets are passing to a surviving spouse then there’s also no inheritance tax to pay in that circumstance either. Also I thought it was worth mentioning, if one spouse does pass away and they don’t use any, or all of their nil rate band, the unused part of the nil rate band does pass to their spouse to use when they pass away.

So that’s something to bear in mind. Well, any of an estate, which is over the nil rate band is taxable. The inheritance tax rate at the moment is 40%. This can be lowered to 36%. If at least 10% of a person’s estate is left to charity, or any other general gifts left to charity and fall outside of the estate and are not taxable. With the inheritance tax liability that may fall due, it could be due as soon as six months after the date of death, which can cause problems if there’s no cash in the estate, and it may mean properties need to be sold to pay the liability.

There are things you can think about here such as leaving a pot of cash to cover the potential liability or you could take out an insurance policy, which would cover the inheritance tax due. So that just shows that inheritance tax estate planning is a necessity if you are a landlord. If you’ve been working so hard on building up your portfolio, and you want to pass that on to the next generation. Obviously, you don’t want to pay any tax or as little tax as legally possible, as we like to say. So what possible IHT planning techniques can we use?

Firstly, I want to mention if you make a gift, including a gift of a property, and then you survive for seven years, there’s not going to be any inheritance tax due. And there are a few caveats and implications of that which we’ll come on to later, but as long as you survive for seven years, no inheritance tax due when you die. If you do die within seven years of making a gift, and then there is a sliding scale of tax which is just shown on the previous slide in the table. So as you can see that little table. So for example, if you gift a rental property to your child, and you die between five and six years later, there’ll be inheritance tax due of 16%.

And if you make the gift and then you pass away within three years, unfortunately that all goes into the estate and all that tax is due on that property. So there are a couple ways to gift a property that I want to cover today. And you can gift a property whilst alive into a trust. Now this may seem like a really appealing option, as there is no inheritance tax to pay if the value of the property or properties is below the nil rate band of 325,000.

And if the value is more, then there would be inheritance tax to pay. So that is obviously worth considering. We’ve also got to remember that any rental income which goes into the trust will still be assessed for income tax.

And these rates can be quite high and higher than the basic rate levels of tax which you might pay as an individual. We also need to remember that if the length of the trust reaches 10 years, on the 10 year anniversary of the trust there will be a tax charge which then again, is charged on every 10 year anniversary going forward. There are also exit charges we need to remember about.

We need to think about the cost of setting up the trust in the first place. And also the management fees or annual fees going forward, which will be charged to administer the trust. So this generally only makes trust beneficial if the main aim is to protect the assets, and not to save tax.

So if you want to pass property on to children or grandchildren that are perhaps under 18, or if you want to pass to someone who can’t take the responsibility right now, then yes, trusts are definitely an option. But we’ve just got to remember there may be extra charges involved.

So an alternative is to gift properties to individuals outright whilst you still alive. So like I said, any gifts made and then you survive for seven years, there’s no IHT to pay, which is great but in order to qualify for this relief, you as the person gifting the property must forego all rights to the rental income from them on.

So if you need that income from the property still to live, if you cannot live without that extra income then gifting the property might not be for you. Also when you gift a property, even though it is a gift and no funds are being exchanged and the transaction does trigger a capital gains tax calculation, and if there is a gain on that property, because the market value at the date of the gift exceeds the acquisition cost then there will be a gain, and that needs to be paid to HMRC within 30 days of the transfer.

So you need to consider whether you’ve got the cash put aside for that tax payment. And with gifting there is potential for more flexibility if the properties are held in a limited company. And that’s something we’re going to discuss in a moment.

NJ: So before we go into how you move the properties into a company, there’ll be a lot of landlords here at the moment who are thinking, Okay, you think about the whole company setup, and regardless whether you holding it in a company with multiple portfolios, or you only end up with a bit of it in your personal assets, what we’re trying to achieve here with Mashroom is giving you the ability to manage your property efficiently, but through our dashboard.

So a lot of us are working from home at the moment. And if you work from home, there’s so many people who’ve been using Microsoft Teams, Google Hangouts, we use Slack. And we all know how important it is to be able to communicate constantly and effectively.

So the Mashroom platform allows you to directly message your tenants, that’s before they become a tenant at the point of viewing and that’s all the way through the period of their tenancy. So one, communicating effectively and that’s what we give you. The next part as well is okay, we know as landlords there’ll be issues, there’ll be repairs, something will break inside the house.

And a lot of the time we end up having to go to another agent and saying, “Okay, look, there’s been a problem, just fix it.” Which is where you then end up with a 10% uplift that they then apply to the repair cost.

With Mashroom, we’ve actually got a partnership with Local Heroes as a part of the British Gas initiative. And you can order all of your repairs through there and the best thing is we’re not going to take an uplift. So you’re able to go to the contractors directly, and organize and schedule the visits that are needed through the dashboard. The next part is the paperwork.

So I think all landlords think most of us hate paperwork. The best thing is we also give it all within the dashboard. So your tenancy contracts are all within the dashboard. And you can add clauses, whatever it is that you want to add, and we don’t charge again, for this.

We believe it’s just a part of the service and trying to make it as accessible as possible. So we’ve done all the legal work for you there. But the great thing is, it’s all on one dashboard. So again, if you take the moment to go to join.mashroom.com, you’ll be able to see the dashboard and I’ve seen a couple of messages. So to make it clear, it is a free to use platform.

So definitely had that and it will help you with building your company if you decide to keep as a company or you keep it as a personal property. So Chloe, it’s now time for you to finally tell everybody what they’ve all been waiting for. Should they move their properties into a company?

“Should I move my properties into a limited company?”

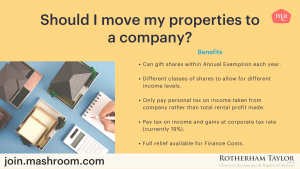

CG: Well, what a question. Part of that question would also be, should I transfer my properties through a limited company as well as transfer in property you already own into a limited company? Should I purchase my properties in a limited company straight away? So as I mentioned earlier, having your portfolio in a limited company offers greater flexibility with gifting. If you cannot afford to gift the property in full, like I said earlier, and you still need the rental income in your own pocket, a company allows you to gift a percentage by just gifting a proportion of your shares.

Also by gifting some of your shares each year, you can take advantage of the capital gains annual allowance. So there’s no capital gains tax to pay if you just transfer proportion, which stays within that allowance each year, which is great tax planning. A limited company also allows you to have different classes of shares.

CG: And with those different classes, you can pay different rates of dividends on each class of share. So this allows for differing levels of income. And you can take advantage of the people with the lower tax rates and pay them more, whereas if there’s people are paying higher rates of tax, then you can pay them less, so you’re not paying as much tax.

And talking about the different levels of income and tax, if you don’t need the income in your own pocket right now, or you don’t want to perhaps be pushed up into the next tax bracket, then you can leave the profits in the company and you don’t have to suffer any income tax. Obviously, if you hold them as an individual, you’re taxed on the whole profit no matter if you use that cash personally or not.

CG: With a company as well, there is no different rate when you sell a property, income and gains are all taxed at the corporate tax rate which as mentioned earlier is currently 19%. And as Simone did say, if you are a high rate tax payer, you don’t get full relief on your finance costs when you hold property as an individual, whereas if you hold in a limited company, there’s no restrictions on this, you get the full relief.

So there’s lots of flexibility and benefits that operate as a limited company. But as we know, there are always downsides and issues too. And they do come with incorporation as well. Firstly, a transfer of a property to a limited company from just holding it personally, triggers a capital gains tax calculation.

CG: And if there is a gain, again, this is payable to HMRC within 30 days, so you need to have that cash there. And However, there is something called incorporation relief where capital gains tax is avoided if you meet the conditions, but you do need to meet these tight conditions, which include that you must be running a business already to start with. So in HMRC’s eyes this means you’re generally spending 20 hours a week and managing your portfolio.

So it means it’s all about the quantity of properties rather than the quality of income, obviously, you’re spending more time on multiple properties. As well as the potential capital gains tax that might be incurred on the transfer, there will also be stamp duty on the market value of the properties being transferred.

CG: Thinking about inheritance tax, there is no business property relief for shares left in an estate. A rental property business is classed as an investment business, and this means no business property relief, unfortunately. And then thinking about if you have or need a mortgage? Is it possible to get one as a limited company? Or is it as cost effective, it’s not always as easy and it’s sometimes more expensive to have a mortgage in a limited company as opposed to as an individual.

So if you are a highly geared portfolio, something really to consider the implications of withholding property in a limited company that is possibly… You might encounter something called annual tax on enveloped dwellings. If the property value in your limited company is more than £500,000.

CG: This can be a complex area so any questions please do send them in. And then as a last point, and I stated earlier corporation tax rate is currently at 19%. Estimates say this is increasing in 2023 for businesses with profits over £50,000. And whereas this might not affect a lot of you, there might be some of you out there with large portfolios and generating large amounts of profit. So for businesses with profits over 250,000, the rate is going up to 25%.

And then the bit in between 50,000 and 250,000, there’s going to be a marginal rate. This is just another great example of why planning in advance, doing calculations on different scenarios is so important to ensure you get in the right structure for you. And I think that probably just about covers it.

Q&A

NJ: Okay, so what’s next, so we are going to be going into a live Q&A. To manage expectations here we’ve got over 800 people on this, 1800 people rather, on this call and over 400 questions now. So we’re going to answer as many as we possibly can on this call. But on Monday you… Sorry, on Saturday, you will receive an email from us on that email you will be able to place the questions that you have, and select the department you’d like the questions to go to. So is it Mashroom? Is it to our accountants?

Do you want to speak or send a question to one of our mortgage advisors? So we will send you some emails so that you can follow on from here. But also if you join.mashroom.com, you’ll be able to see our past webinars, you’ll be able to see the recording of this webinar, which I think answers many of the questions I’ve seen. And yes, we are recording and we will make this available on our dashboard.

So all you’ve got to do is join.mashroom.com. On Monday, we launch our new podcast series where Simone is also featuring giving us some top tax tips.

So you’ll be able to have access to the podcast through there as of Monday or Tuesday. And you’ll also get access to our landlords magazine, which gives lots of information, especially about COVID furlough, how that’s affecting tenants and what landlords need to think about next. So without further ado, I think it’s time for us to head over to the questions. So the first question then we will take is for you Simone. Simone, this is a question from Tom, how do I know if I’ll pay tax at 20% or 40% on my rental income?

“How do I know if I’ll pay tax at 20% or 40% on my rental income?”

SB: Great question. So when you think about your income as a whole, it’s taxed in a very specific order. And it goes non-savings income, savings income and dividend income and rental property falls into that first tranche that’s known as non-savings income. But that bracket also includes things like salaries and self-employed profits. So you would look at all your income that’s in the non-savings income band.

And when you add that together, if it comes to more than £50,000, you’d be paying tax at 40%. If it’s less than £50,000, you’ll be at 20% just as a general rule.

NJ: Perfect. Thank you very much, Simone. Chloe, if an estate doesn’t have enough money to pay inheritance tax, who will decide on the recipient?

“If an estate doesn’t have enough money to pay inheritance tax, who will decide on the recipient?”

CG: So when somebody dies and there’s an estate, executives are appointed or personal representatives and they will handle all of this. And but they’ll generally work in an order and leaving specific items left to specific people. And yeah, they’ll decide what gets sold first, and in what order there then given out.

NJ: Thank you very much, Chloe. So I’ll take the next one. I’ve seen this come through a few times now. This is from Marcus, but many others. How can Mashroom offer a free service?

“How can Mashroom offer a free service?”

Well, it’s very simple. We give you all the services you need to make you a sustainable and profitable landlord. Where we make our money is through offering you optional services, so services that you’d need anyway. So an EICR, doing a reference check, an inventory, being able to offer your tenants deposit replacement products.

So that’s where we’d make our extra money or make our money is by offering you the services that you need anyway, but you can choose if you want to use them via Mashroom. But also it’s always really important for me to make this point. We don’t inflate the prices. So for instance, I think I told you earlier, tenant referencing is £15 per tenant, as opposed to £100, if you look at some high street agents.

So it’s all about making it sustainable. So I hope that answers that question. The next question then Simone, we’ll go to you. And this is, why are companies allowed to claim for more expenses than a normal landlord?

“Why are companies allowed to claim for more expenses than a normal landlord?”

SB: So when I was running through the expenses, I only spoke about very specific rental property expenses, but you’re quite right. Companies can claim for extra things, such as, salaries. You can pay yourself a salary through a company or you can perhaps pay punchy contributions, things like that. And the reason for that is that companies are separate legal entities to individual landlords.

So there are costs involved with running the company and stuffing it for example. So that’s why companies are generally able to claim more expenses than just an individual landlord.

NJ: Thank you, Simone. Chloe, I’m not going to accredit this to anybody because it’s been asked so many times. Should I put my rental properties into a trust?

“Should I put my rental properties into a trust?”

CG: It’s not a simple question and unfortunately it doesn’t have a simple answer either. And as I mentioned earlier, trusts do have some of the highest rate of tax and can be expensive to set up and manage. So it’s something that would need to be looked at on a case by case basis really. And it would require a full tax plan exercise to see if it is worth you putting your rental property into a trust.

“Have recent events continued to stunt the mortgage market if I want to buy more properties?”

NJ: Thank you very much. Okay. So one that I’ll take then. Have recent events continued to stunt the mortgage market if I want to buy more properties? It’s no secret that last year with COVID and everything else going on, lenders became far more cautious, so we saw rates being taken off the table, and there was a lot of delays within the mortgage market. We have seen that return to normality or some form of normality.

Was it because they were worried about the impact that COVID was going to have on the economy? Maybe. Was the majority of the reason because they were trying to operationally send everybody home to work?

I think that was probably the biggest concern they had. So they have now resolved that blockage. Mortgages are now widely available. We’re starting to see less issues with mortgages so less down valuations. But the best thing I can suggest is if you’re looking for a mortgage at the moment, on Saturday you will receive an email from us.

Speak to our mortgage team, they’re really helpful, and they’ll be able to tell you what’s the best rates for you, or do you currently have the best rate or what’s available to you. So reach out to them as soon as you receive the form on Saturday. Chloe, how will I know if I qualify for incorporation relief?

“How will I know if I qualify for incorporation relief?”

CG: Unfortunately, HMRC, I won’t tell you in advance now. If you do qualify for incorporation really you used to be able to apply for clearance full. They took that off the table, there were so many people. Doing that they’ve cut some work out for themselves, but I think if you spoke to an expert and just discussed and if, like I said before, if you are running a business, you are spending 20 hours a week managing your portfolio then you would expect to qualify for the incorporation relief. But yeah, I think it would be best to have a chat with us and we could help you further on that.

NJ: Brilliant. Thank you very much. Let’s go to some more of the questions then. Simone, what parts of my car usage can I use as an expense?

“What parts of my car usage can I use as an expense?”

SB: You left the question ninja at the minute, because I’m answering live and I’m in the Q&A at the same time. So for a car, what I would generally say is she needs to be keeping a mileage log to verify where you’ve been going and what you’re claiming for HMRC’s biggest thing to ask for when they’re talking about travel expenses is where’s your mileage log.

So once you know how many miles you’ve done a year, you could possibly claim the HMRC approved mileage rates, or if you wanted to you could look at your business mileage as a percentage of your total mileage and then claim that percentage of your overall motor running expenses. So things like fuel, repairs, amounting all that sort of stuff.

NJ: Great. Thank you very much. Let’s go to the next one. Chloe, we’ll give you one. For inheritance purposes, can I pass on shares to my heirs, but retain control of all of the income and profits?

“For inheritance purposes, can I pass on shares to my heirs, but retain control of all of the income and profits?”

CG: That’s where we would use the different classes of shares, and then you can retain some of the control. You can just pay dividends on your class of shares, but the heirs do own some shares as well. So it might be that over time you tip those scales as when you don’t need the income anymore. But yeah, the shares and the different share classes does give that flexibility in order to do that.

NJ: Simone, I’m going to ask you two questions, because I think they’re both easily answered in one answer. So does owning a property jointly affect capital gains tax allowances? And second question is how much annual exemption of capital gains tax is each person allowed? And how many years can we carry back?

“Does owning a property jointly affect capital gains tax allowances? And how much annual exemption of capital gains tax is each person allowed? How many years can we carry back?”

SB: So owning a property jointly does affect your CGT allowance in that you can effectively claim two allowances against the same property. For the tax year that we’re in at the moment, the CGT allowance is £12,300 each. It is one of those use or lose, so you can’t carry it forward or back, but if you do have losses, you can offset those against your profits which could potentially reduce the amount of capital gains tax you are going to pay.

NJ: Perfect. Chloe, Mark and three others have asked this question, is there a cost to transfer property from a sole trader to a limited company?

“Is there a cost to transfer property from a sole trader to a limited company?”

CG: So like we discussed earlier, it can trigger capital gains tax and it can trigger stamp duty. And also you would need to think about the fees for setting up a limited company, solicitor costs to do the paperwork, to do that trance there. So as well as the tax, there are other costs involved that you need to consider.

NJ: Okay. We are going to get three final questions. So Simone, back to you. How does the property income allowance work?

How does the property income allowance work?

SB: I personally love the property income allowance, probably more beneficial for people who only have one or two properties. And the way it works is rather than claiming a deduction for the expenses you’ve actually incurred, you can treat £1,000 of your rent effectively as being tax-free. So if you have a property that doesn’t have a mortgage and you’ve got very little expenses, say a couple of repairs and some insurance, the chances are that the property income allowance will be higher than the expenses that you’ve paid. So you’ll pay less tax than normal, which is a win for everybody.

NJ: Chloe, this question is from Helen: is there no tax due, if you survive seven years, if your estate is valued over 325,000?

“Is there no tax due, if you survive seven years, if your estate is valued over 325,000?”

CG: So if you gift something and it’s over 325,000 and you survive for seven years, then there would be no inheritance tax. But if you didn’t survive seven years, anything over the 325,000 would fall into the estate.

NJ: Great. And then final question. Simone, this is from Jeremy. Do you effectively get taxed twice on income withdrawn from a property company i.e. once of higher corporation tax then again, when you eventually withdraw income?

“Do you effectively get taxed twice on income withdrawn from a property company i.e. once of higher corporation tax then again, when you withdraw income?”

SB: I suppose the short answer to this is yes, but sometimes what you find is if you add together the corporation tax on the company profit and the income tax that you pay to get the money out of the company, it could be less than the income tax you would pay just on the profit. The reason for that being that most people will withdraw funds from their company, its dividends and their dividend tax rates are actually quite low. So in the basic rate on joint dividends are only taxed at seven and a half percent compared to your normal incoming tax at 20%.

NJ: Perfect. Thank you very much. So if we just switch over, so let’s go through the results of the poll everyone did at the beginning of the webinar. So interestingly, 64% of you said that you all communicate with your tenants directly, which is brilliant. And that’s even more reason why Mashroom probably likely to work with you. 17% said through an agency, 3% of you said that you don’t, I’m assuming you are the nonlandlords in this group at the moment.

Are you happy with the relationships you have with your current tenants? What’s really good to see is that over 90% of you all have a really good relationship with your tenants and that’s even more what we are trying to encourage through Mashroom. Let’s have good relationships with our tenants. It’s less likely to cause us frictions later on.

NJ: If the eviction ban did not exist, would you have evicted any of your current tenants? 85% of us said no, which is brilliant but 15% you said yes. So those are the polls, I think those are really, really interesting. And thank you for taking a moment to fill those out for us. So to reiterate again, if you head to join.mashroom.com, you will be able to sign up and get access to some of our free information on there.

You’ll be able to see here, Simone, Chloe and myself, and our email addresses. Also we are all on LinkedIn, so feel free to take a jot of our name and address. We are a friendly bunch. We’re happy to accept you all and have a conversation. And then for the final part then… Just waiting for the screen to change. Let’s just hand over to the ladies, just let you know how RT accountants can help you.

CG: Yeah. So how can RT help you? As all the usual services you would expect from accountants we can provide, whether that’s personal tax return for the personal landlords, or set up accounts for anyone with a limited company. We really want to help with the advice side, helping you decide how best to structure your investment. As we’ve discussed today, there’s loads of things to consider. It’s a minefield, so let us help you with that and decide whether you are best to stay a sole trader or transfer properties to a limited company. We can guide you through the allowable expenditure.

CG: Again, as Simone’s gone through, there’s lots of different expenditure that you can put through, and then also ones that you can’t. Dealing with all tax compliance, yes, but also about the new or the new-ish capital gains tax returns due within 30 days after the sale. And also with making tax digital, which will be coming in soon, and again, it’s something you will need to consider. And then just advising you on what tax to pay and when to pay it and how to pay as little as possible. So if you do have any further questions or need any advice, like Naveen said, drop us an email, contact us on LinkedIn, or check out our website.

NJ: So tomorrow morning you will all receive an email for the people who have asked, it’s totally free to inquire and send us questions. So whether that’s to our mortgage advisors, whether that’s to Mashroom, whether it’s to our accountants, absolutely get in touch with us. We are all ready and waiting to help you. And if you want to jump the gun, I’ve got people in Mashroom ready to help you today and tomorrow and through the weekend. So thank you all for joining. Thank you very much.

CG: Thanks everyone.

SB: Thank you.

NJ: Cheers all. Bye.