UK Market Crash Could Take Nearly Eight Years for Property Prices to Recover

So you’ve just had a dedicated agent value your humble abode at a price that has you trying your hardest to contain excitement.

You crack out the calculator and do the numbers, seeing how many shiny gold coins you’re going to get when someone buys your awesome home. But then it dawns on you: selling a home is such a significant transaction. Do I have to pay anything to get it done?

The bad news is, yes, you do. Unfortunately, selling your home isn’t free, even if you list it on Craigslist (don’t do that). The good news, however, is that we’ve put this post together to give you a clear idea of what selling your home entails from a financial perspective.

Put the calculator aside for one second, and read on to find out how much it costs to sell your home.

– £190,032 – 2007

– 18.72 – 18 Month Crash

– £154,452 – 2009

The Research

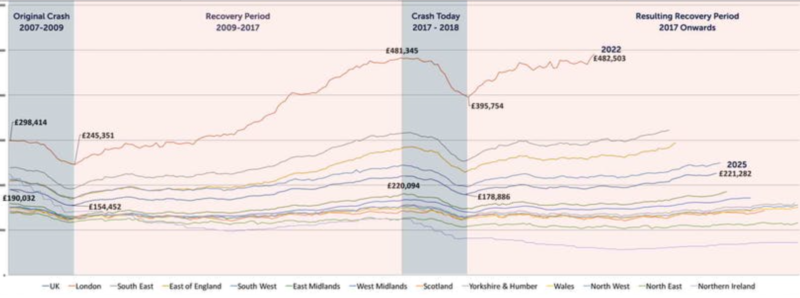

Using data from the Land Registry, we looked at the fall in property prices across each region at their pre-crash peak in 2007 and their lowest point in 2009, before values started to appreciate again. Using the current average for each region, we then worked out what an identical drop over the same time span would mean today, before using monthly price growth data from the markets previous recovery, to work out the total time frame it would take for prices to return to their current level (crash plus recovery).

UK Crash Impact and Recovery

Between the end of 2007 and early 2009, the average UK house price fell by nearly 19%. At today’s current average of £220,094 the same drop would result in the value of a property falling to £178,886 and a loss of £41,208 over 18 months.

– Current Average – £220,094 (2017)

– Post-Crash – £178,886 (2018)

– Recovery Period +23.70% (7.7 Year)

– Once Recovered – £221,282 (2025)

Based on the previous market recovery time and monthly price trend growth, it would take 7 years and 7 months for the market to make a full recovery and would require an increase of 24% to bring the average house price back up to a similar level as today (£221,282) – 7 months longer than the previous recovery period.

Crash Impact and Recovery by Region

Looking at each region individually, it is, of course, those in London who would see their property price return to normality the quickest. During the previous crash, it took London house prices 4 years and 7 months to return to the £298,000 threshold after they started to fall.

Today if the market were again to drop by 18%, it would wipe more than £85,000 of the average London house price, reducing it to £395,753. Based on the previous market fall and turnaround, it would take 4 years and 7 months for the London average house price to increase by the required 22% to once again exceed £480,000.

The South East saw the largest fall of all regions during the last crash but the higher buyer demand in the market means it would take the second shortest time to recover out of all UK regions (6 years, 5 months), followed by the East of England (6 years, 7 months), South West (7 years, 8 months), East Midlands (7 years, 9 months) and West Midlands (8 years, 5 months).

Although the market in Scotland has recovered a similar crash would require a 8 year and 8-month time span to fall and then climb by the required 17%, and push the average house price back over £140,000. The average house price in the Yorkshire and Humber region was also slow to recover, returning to its pre-crash peak of £149,366 in the middle of last year. However, a similar crash today would result in a recovery time of 9 years and 6 months for the market to once again return to strength.

Regions Only Just Recovered from Previous Crash

The slow rate of growth since the last market crash in both the North West and Wales means that the average house price across the two has only recently returned to previous pre-crash levels. Like Yorkshire and Humber, the slower market recovery since 2009 means that a similar crash today would take 9 years and 7 months to recover to the current average.

Regions Yet to Recover from Previous Crash

Unfortunately for homeowners in the North East and Northern Ireland, the markets have failed to recover to the levels enjoyed prior to the last crash. Before the crash, the average house price in the North East was £138,306 and £224,670 in Northern Ireland but post-crash they slumped to £117,079 and £140,190.

Since then, the average house price in the North East has crept up by just 9.16% to £126,738 but in Northern Ireland prices have continued to decline, down -11.18% with the average house price now just £124,007.

The same crash today would put the average house price in the North East region at just £107,286 and based on previous market recovery trends, it would take nearly 18 years just for the market to return to current depleted values, let alone pre-crash levels.

There is no telling if the Norther Irish market will regain strength but a similar crash today could be disastrous and push the average house price as low as £77,378, with the further decline pushing values even further below this.