Rental Industry Jargon, Explained

Absent landlord:

If you are unable to contact the landlord directly they are known as being ‘absent’. If this is the case, don’t fret, your first point of contact should be the letting agent.

Administration fee (Wales only):

This is a fee charged by the letting agency and paid by the tenant that covers the cost of processing a property rental.

Agreement fee:

Usually split between the landlord and the tenant, this is a fee that covers the cost of drawing up a tenancy agreement.

Arrears:

Late or unpaid rent that the tenant owes the landlord.

ARLA Propertymark:

The UK’s number one professional body for letting agents. This association works to help tenants and landlords and encourages education and qualifications within the housing sector. 9,000+ letting agents are ARLA Propertymark Protected, meaning they have higher standards than the law demands. Pretty nifty.

Assured Shorthold Tenancy:

The most common type of tenancy. An AST is used when rent does not exceed a year, covers a fixed period and where the tenant is an individual.

Break clause:

This allows either the landlord or the tenant to give written notice in order to terminate the tenancy before the original date agreed. Usually a break comes into play after a certain date is reached in the tenancy.

Client Money Protection:

This is a scheme that protects money paid by tenants to their landlord or letting agent. It’s a legal requirement, so double check the CMP is in place before signing the dotted line.

Common parts:

Any areas that are shared amongst tenants.

Credit search references:

These are references that are requested by landlords and agents in order to assess a tenants’ financial stability to rent. Employers may be contacted and credit histories may also be checked.

Default fees:

These fees apply to things like lost keys or late rent payment. They must be seen as ‘reasonable’ and must have supporting evidence provided by landlords or agents.

Security deposit:

This is a sum of money paid by the tenant and held by the landlord or agent against damage to the property or in case of any breach against the tenancy terms. Security deposits are capped at five week’s rent.

Deposit Protection Scheme (DPS):

The deposit protection scheme is a government authorised scheme where the tenant’s deposit is stored for the duration of the tenancy. The deposit is then paid back to the tenant after an agreement between both parties has been reached. This scheme is free and open to all landlords and letting agents. Result!

Dilapidations:

If you damage any items during the tenancy, these become known as dilapidations. The tenant is usually responsible for replacing or paying for reparations, so tread lightly.

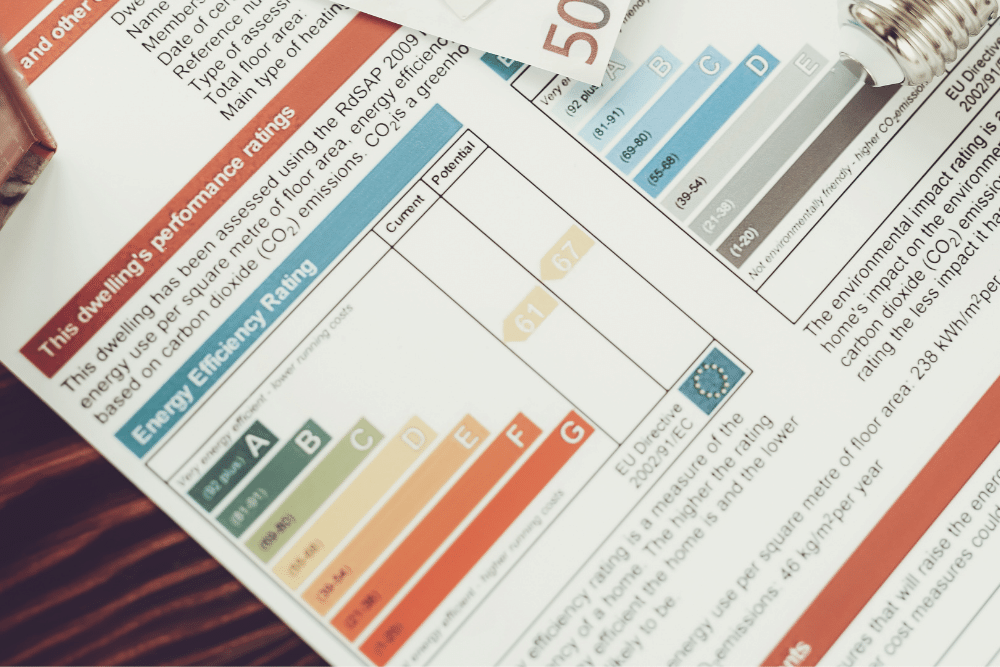

Energy Performance Certificate (EPC):

An EPC shows the energy efficiency and carbon emissions of a property, which means it also gives an indication of what fuel bills will cost. It is presented as two graphs, namely the energy efficiency and environmental impact of the property and ranks from A (the best, obviously) to G (the worst). Landlords are required to supply tenants with an EPC.

Eviction:

Evictions are a sanction that are normally put into place when a tenant is in serious and repeated violation of their tenancy agreement.

Fixtures and fittings:

These are items included in a let and usually consist of curtains, carpets, blinds, light fittings, kitchen units and appliances. On occasion, furniture is also included but this will be noted in the lease agreement.

Gas safety record:

A certificate stating that all gas appliances, pipework and flues are safe. These are required by law to be renewed annually.

The Government’s Rental Guide:

A helpful step-by-step guide to help landlords and tenants alike understand their rights and responsibilities. You can download it from the Government’s website and landlords must provide tenants a copy at the start of their tenancy.

Guarantor:

Tenants typically need to earn 2.5x the annual rent to qualify. If they don’t, or if they fail reference checks, a guarantor is often required. A guarantor does what it says on the tin and guarantees the rent in the event that the tenant is unable to pay.

Holding Deposit:

Paid to reserve a rental property before signing the tenancy agreement.

Houses in Multiple Occupation (HMO):

A property qualifies as an HMO if it has three or more tenants, consisting of more than one household and tenants share bathroom, toilet or kitchen facilities.

Inventory:

Basically, a contents list for the rental property. This includes the condition of the items and details of existing damage.

Landlord:

The owner of the property. The tenant (you) enters into a tenancy agreement with them.

Letting agent:

Private landlords often use letting agents to let their properties. They have a range of responsibilities, such as finding a qualified tenant for the landlord’s property.

Notice period:

The amount of time a landlord or tenant must give to end their tenancy agreement.

Redress scheme:

It is required by law that a property agent joins a government authorised consumer redress scheme. This is to give clients of the agent a way to take a complaint further if they are unhappy with how their initial complaint has been dealt with. The Property Ombudsman (TPO) and the Property Redress Scheme (PRS) are the two government accredited schemes property agents can use.

Renewal:

Once your fixed-term tenancy comes to an end, you can choose to renew the contract if both parties are happy.

Right to rent check:

A check issued by landlords and agents to ensure that a tenant has the right to rent in the UK. If this is not completed a fine may be issued, or in severe cases, imprisonment.

Subletting:

This is when a tenant sublets a property to another tenant. You must have the landlord’s permission before you sublet. Otherwise, you will be in breach of the tenancy agreement.

Tenancy:

The possession of a property under the terms of a lease.

Tenancy agreement:

The specifics of how long a tenancy will last.

Tenant:

You! Otherwise known as the person who has temporary possession over a property under a lease.

Zero Deposit Scheme:

This is a new scheme that helps tenants rent without having to pay the full amount of a traditional security deposit. Paying the equivalent of a week’s rent, a tenant can move in under the Zero Deposit Scheme. It provides the exact same protection to tenants and landlords as a regular security deposit.