Is Your Pension Growth About To Be Slashed?

Pensions are not the most glamorous element of finance. They don’t hold the same heart-stopping excitement as your first mortgage, or the potential of an investment in the markets.

But, like a pair of old slippers, there is an undeniable excitement that comes from that warm, cosy GROWN-UP feeling that comes from when you have your retirement under control.

However, the pensions surety that we have enjoyed for so long may just be starting to look a little wobbly… and guess what, it’s all courtesy of Covid.

Security in retirement, right?

Currently, everyone who receives or is eligible for a state pension can relax in the knowledge that their government backed retirement pot is designed only to climb, and that your state pension is unable to suddenly plummet. This growth protection, known as the Pension Triple Lock, is part of a manifesto promise made by the Conservatives at the start of their five-year term.

The triple lock scheme works on a simple premise, designed to ensure that the state pension increases every year in line with the rising cost of living. These figures are calculated on either living costs as calculated by the Consumer Price Index’s measure of inflation, increasing average wages or 2.5%. Whichever cost is highest is the amount the Government hoicks pensions up by. Simple, and logical.

With this in mind, the drinks should theoretically be on the nation’s pensioners come the pension reform date in April 2022, as a recent sharp rise in national wages following the dark days of Covid should see us celebrating a huge leap in pension pay-outs.

Wage hike

Wage hike

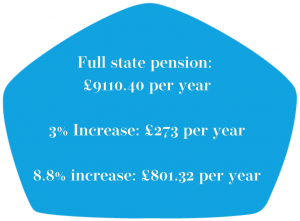

The Office for National Statistics has recently published data that shows how the nation’s earnings has grown a whopping 8.8% since the pandemic period, thanks to many of us getting back to relative normality after months of redundancies, wage hacks and furloughs. Great news for everyone who is enjoying a bigger wage packet, but also brilliant news for pensioners protected by the triple lock, which could see their state pensions increase by over £800 a year in 2022.

Not such a brilliant day in the office for Chancellor Rishi Sunak though, who is already faced with some pretty sparse looking Treasury accounts – this turbo-charged boost to pension pots nationwide is not an appealing prospect.

Uncertainty at No.10

Financial squeezes on the Treasure has left Sunak frantically counting the coffers, and looking for places to claw back funds wherever possible. Everything from

- the lengthy furlough scheme

- business bail-outs

- medical research and PPE

Has added extra pressure since the start of the pandemic. We have all seen snips here and there to services, and it is likely that the pension triple lock will be another casualty of the Covid crisis.

The Chancellor has made no secret that he would break the triple lock manifesto promise, with options to instead either use underlying wage data that doesn’t take the pandemic peak into account, in order to ensure ‘fairness for pensioners and taxpayers’, or move to a double lock premise, taking wage data completely out of the equation.

Boris Johnson, however, is reportedly not overly keen to rock the boat, with retired voters making up a huge part of the Conservative key support.

What does it mean for the state pension 2021?

Sunak has warned that if he had to find an additional £4billion to pour into pension funds, other key spending priorities would suffer, and it should be considered where these cuts are going to be made. Would these undoubtedly hefty public service spending slashes impact the elderly population just as much as a trimmer pension hike might…

Cards are being played close to chests at the moment, and no official decisions are likely to be made until late Autumn.