Do I need an EPC When Selling My Home?

What is an EPC?

What is an EPC or energy performance certificate?

In short an EPC is an asset rating that tells you how energy efficient your property currently is and what sort of impact it has on the environment as a result.

What type of EPC do I need?

What type of EPC do I need?

For domestic housing, or a self-contained dwelling as it is classed by the government, you will require a domestic EPC. The type of EPC will also vary depending on whether your property is an existing or new build.

Energy Ratings

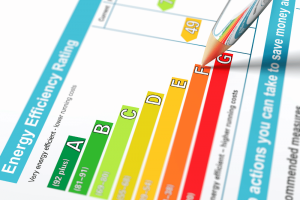

The energy performance of your property is determined and measured on a scale of A-G, A being the most energy efficient a building can be. The average in the UK for an existing property is usually around a D rating although anything lower than this means your CO2 footprint starts to increase.

On completion of your energy assessment you will receive recommendations on how to improve your properties energy efficiency rating as well as your EPC certificate. Not only does this help towards making your homes environmental footprint a little greener but it can also save you money.

How do I get an EPC and how much does it cost?

An EPC can be obtained by using a government accredited energy assessor to assess your property and produce the certificate. Each accredited assessor is issued with an identity card so be sure to ask for this when they visit your property if you have any concerns.

They will also keep a record of your assessment on the national register once arranged. Only EPC’s found on this register are valid so if you are having trouble finding one for your address it is likely it does not have one, if you think you should have one then contact the company that carried out your assessment immediately.

According to U-Switch, an EPC can cost up to £120+VAT depending on which route you go down, with Emoov its just £59+VAT. With everything it pays to shop around in order to find the best deal and generally speaking it will cost less if you approach the assessor directly rather than via your estate agent.

That is of course unless your estate agent is Emoov. As part of our unbeatable service we offer the option of adding an EPC assessment to your listing package, at just £59+VAT.

Why is this any better than going direct?

All of our assessors nationwide are qualified to carry out your EPC assessment and produce your certificate.

This means when they visit your home to compile the floor plan and photos, they can take care of your EPC at the same time, killing two birds with one visit. This means you can take care of the lot at once and won’t have to hang around all day waiting for an external assessor to show up.

Do I need an EPC to sell my house?

Do I need an EPC to sell my house?

How long does it last?

An EPC lasts for up to a ten years and a property can be marketed immediately upon its commission. However, if the property is removed from the market for four weeks or longer and your EPC has expired during the marketing process you will need to renew it before the property can be remarketed.

If you have recently had an EPC assessment carried out, you shouldn’t have to worry about another one for quite some time.

But if you do need one, check Mashroom’s EPC service today!